FUND ACCELERATION

A fresh perspective for the changing private equity market

Halcyon partners with private equity firms to build wealth for it’s investors by improving the quality of deal origination leads, transforming underperforming assets, and accelerating financial performance to align with fund exit objectives.

Halcyon creates instant infrastructure, stability, repeatability, and scalability by utilizing a highly involved, hands-on approach to portfolio company management by embedding our team of business service experts to optimize enterprise value.

DEAL ORIGINATION

Deal Origination for most private equity companies tends to be inefficient and labor intensive. Identifying the right investment prospects is both art and science, combined with the network, discipline and infrastructure to efficiently market and evaluate those prospects prior to performing further due diligence.

Halcyon works with private equity companies to implement the necessary resources, processes and systems to identify quality prospects, quickly evaluate them against fund criteria, and prepare the documentation necessary for further due diligence.

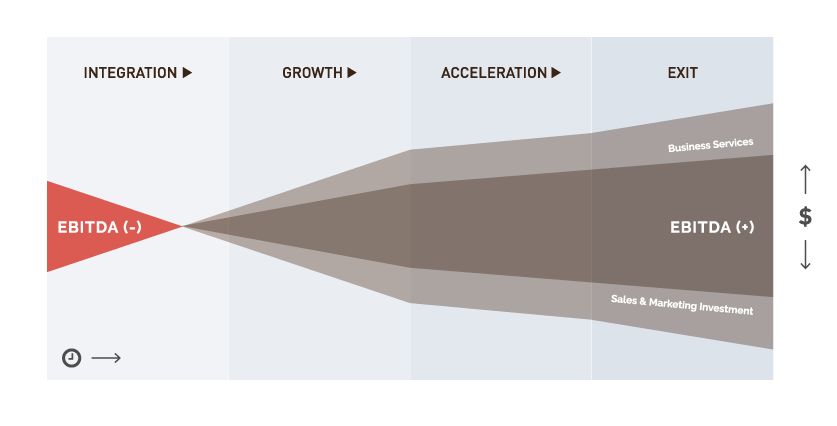

The Halcyon Effect

Our platform for private equity was developed to reduce risk, maximize efficiency, and dramatically improve the valuation of portfolio companies

Halcyon creates instant infrastructure, stability, and efficient scalability, which leads to businesses becoming more profitable in a shorter period of time.Investments in Sales, Business Development and Marketing ignite both positive Revenue and EBITDA growth.

Extracting further efficiencies from Business Services, while accelerating the investment in Sales & Marketing will increasing drive the company to achieving fund expectation. As the business approaches Exit, the focus turns to optimizing investor returns through increasing EBITDA and ensuring SG&A objectives are. Halcyon works closely with our PE partners to prepare for the exit of portfolio companies.